Tuesday, October 08, 2013

Affordable Las Vegas Master Planned Communities

Tuesday, April 10, 2012

Las Vegas Shadow Inventory - Foreclosure Fact or Fiction?

"Where have all the homes gone?!" In the Las Vegas real estate market it's like the clock has suddenly been turned back to the year 2004. Within hours there are multiple offers on everything listed under $250k, often sight unseen, and most accepted contracts are going above list price. New home builders are warning real estate agents about imminent price increases.

At the beginning of November there were approximately 11,500 single family homes actively on the market that were not yet under contract. Today, less than 6 months later, there are only 5,074 active single family listings in the Las Vegas MLS. That's about a six week supply at the current rate of absorption.

This is a direct result of Assembly Bill 284, which effectively stopped the non judicial foreclosure process in Nevada. Before AB 284 became law, lenders were filing around 5,000 Notices of Default per month. Now that figure is down to about 300 a month. Actual foreclosures are down to about 800 per month, and even that figure is dwindling rapidly. REO teams are downsizing staff and services, as there doesn't seem to be an end to the drought any time in the near future.

So where is the "shadow inventory" we keep seeing in the news? Since Nevada lien holders can no longer foreclose on properties non-judically, they have gotten much more aggressive about encouraging and approving short sales. Many owner occupants with true hardships that don't qualify for loan modifications are receiving cash incentives from $3k up to a whopping $30k for cooperating in a short sale.

Lienholders are also modifying many borderline loans, often unsolicited. I had a call from one of my clients last week. He had been trying to refinance his home through a new lender. (He was just barely upside down and had excellent credit.) Out of nowhere, he got a call from his existing mortgage lender, Bank of America, offering an interest rate reduction that saved him more than the refinance would have, at no cost, and without extending the life of the loan!

So in the foreseeable future, the "shadow inventory" in Nevada is a myth. And with the Las Vegas economy recovering, by the time AB 284 expires, many Nevada homeowners will be able to achieve a work out solution with their lien holders.

For more news on Nevada's improving economic situation and rapidly shrinking inventory, check out this week's recent news articles:

Single Family Homes Down to Six Week Supply

Las Vegas is a Seller's Market Again

And don't forget, legalized medical marijuana is also coming to Las Vegas. That will mean quite a few people moving to the state (especially the ones that don't like the cold in Colorado!) to take advantage of the new laws shrinking inventory even further. For the latest on the marijuana situation, go to our new site at Las Vegas Marijuana Real Estate today.

Thursday, December 01, 2011

December is the "Black Friday" of Real Estate

For the past three years clients have been telling us they want a “steal of a deal” on Las Vegas real estate. So how come most of them stop looking in December? All month long, December is the Black Friday of real estate!

Savvy shoppers know that December is the best time of the year to buy property for a number of reasons. And that has never been more true of homes for sale in Las Vegas at the end of 2011 with interest rates and prices at an all time low already.

1. Motivated sellers! Many sellers will take their home off the market until after the holidays. This indicates a seller who is less motivated to sell. A seller who keeps their home on the market and easily available for showings wants to make that deal.

2. More negotiating room! Banks and other companies holding Las Vegas foreclosures want to clear their books so their year- end bottom line looks better to stockholders.

3. Less competition! There is less competition from other buyers who are distracted with holiday shopping and company parties. Or they may be waiting for more inventory to come on the market with the New Year. Yes, there will definitely be more listings after the first of the year, but again, these are likely sellers who are not as motivated to sell and may have until late spring or early summer to move.

4. Undivided attention! Real estate agents are less busy during December and have more time to hunt down that really special deal on your behalf. Listing agents are more willing to present lower offers to their sellers. Real estate agents may literally become your best friends during these slow months as they try to keep their sales moving.

5. Easier financing! Federal regulators have been threatening to tighten up mortgage guidelines yet again in 2012, and may also raise the amount of down payment required for FHA buyers. Not to mention that interest rates may also rise. A small percentage of increase in the interest rate means less buying power.

So this holiday season you have a choice: plan for the holidays, or take advantage of real estate’s annual Black Friday deals and plan for your future.

Wednesday, November 02, 2011

Las Vegas Real Estate Weekly Market Report - October 31st

October 31, 2011 - Want to know where the Las Vegas Real Estate Market is headed? Here are your weekly market statistics from Prudential Americana Group, REALTORS®.

•Your Market Report for Single Family homes in Las Vegas. Homes in Las Vegas.

• Your Market Report for Condos in Las Vegas. Condos in Las Vegas.

•Your Market Report for Single Family homes in Henderson. Homes in Henderson.

•Your Market Report for Condos in Henderson. Condos in Henderson.

•Your Market Report for Single Family homes in North Las Vegas. Homes in North Las Vegas.

•Your Market Report for Condos in North Las Vegas. Condos in North Las Vegas.

Monday, August 08, 2011

The Las Vegas Real Estate Agent Who Went Too Far

As Realtors we are programmed to go the extra mile for our customers. It’s all about providing superior service, right? And Las Vegas real estate is super competitive, so you really have to step up your game. Over the years I have scrubbed toilets, cleaned ovens, babysat for pets, helped clients find jobs, and in a couple of instances even let them move into my own home for up to a month when an escrow was delayed.

But sometimes you just have to say “no” to a client, as one Realtor found out the hard way. Below is a true story of the Las Vegas real estate agent who went too far trying to please a client.

“Poindexter” had cash buyers in town that were on a mission to purchase several Las Vegas investment properties. They had already predefined a certain neighborhood they wanted to purchase in – one where the crime index was a bit high - but the prices were cheap and the return on investment was exceptionally good.

“Poindexter” had done his research on the MLS, and had a list of eleven homes for sale in Las Vegas with good cash flow potential ready to show. He and his clients headed out late in the afternoon just as the sun was beginning to set.

About halfway through the list, “Poindexter” and his clients came to a property with no lock box, though the MLS listing indicated that one should be there. This was a brand new listing and the sign wasn’t even in the front yard yet. But the house was supposed to be vacant and the clients were REALLY insistent about seeing it RIGHT NOW, so “Poindexter” circled the home looking for a door that had been left unlocked. (This happens more times than we like to think!) “Poindexter” didn’t find an open door, but he did find a window that was unlocked, so he proceeded to climb through the window and let his clients in through the front door.

Unfortunately for “Poindexter,” one of the neighbors saw his unorthodox method of entry and called the police, who responded quickly. Faster than you can say “commission check,” “Poindexter” and his client were sitting on the curb in front of the home, hands shackled behind their backs while the police tried to contact the listing agent, who, of course, was nowhere to be found.

Overzealous “Poindexter” and his clients were then treated to a tour of local police headquarters. In the meantime, his lovely almost new Lexus was left in front of the home. A few hours later the misunderstanding was cleared up (though “Poindexter” was ultimately charged with illegal entry). Upon returning to the neighborhood via cab, “Poindexter” discovered much to his dismay that not only had the car been broken into and all his “stuff” stolen, but it had also been professionally been redecorated by a graffiti artist. (The all-too-observant neighbor lived behind the subject property where the entry window was located, but couldn’t see the front of the house.)

Needless to say, even though “Poindexter” was trying to please his clients by acceding to their request to view the house NOW, the clients weren’t too pleased with the unplanned field trip to police headquarters. So the ungrateful clients took off in a cloud of dust, never to be heard from again, and “Poindexter” was left with no sale, no car and a police record. There does come a time in every agent’s life when going the extra mile is just going too far, and poor “Poindexter” crossed that line.

Friday, April 08, 2011

Las Vegas Real Estate IS a Depressed Market, But...

Yes, Las Vegas real estate IS a depressed market, but is it truly a buyer’s market? That’s the $64 Million Dollar Question.

The answer is yes and no. Las Vegas is not necessarily a buyer's market, even though it is a very depressed market. At certain price points the market definitely favors the buyers, but in the lower ranges, under $250k, you are in the seller’s ballpark. In other words, lower end properties are already so undervalued that there is stiff competition to purchase. You can’t reasonably expect to low ball something that is already so low that there are multiple offers on it. And yet many buyers make below list price offers (against the advice of their agents) and are angry when they don't get a bid.

Inventory levels have remained steady for the past six months and all cash sales account for over 50% of purchases. Investors are buying Las Vegas because the prices are so low they receive a great return on rental income. So under $250k the competition is fierce. Most Las Vegas foreclosures and short sales are actually selling for MORE than list price as there are multiple offers from these cash investors. Yet even above list price these are great deals FAR below replacement cost and with great rent yields.

But if you are truly looking for more bang for the buck, think about the Las Vegas homes for sale in the higher price ranges. The higher the price point, the more open sellers are to negotiation. There are fewer offers to choose from (unless the property is grossly underpriced which happens often on the short sale listings). Bank foreclosures are much more willing to deal and “real sellers” tend to have more equity. If they have been sitting on their homes for a few years and finally get to the point where they have to move, a real seller can be just as good of a deal as a foreclosure. Plus they come with warranties and are in generally better shape, which makes them less costly in the long run.

Tuesday, April 05, 2011

Las Vegas Real Estate Now Being Featured on Thumbtack.com!

Las Vegas Real Estate is now being featured on Thumbtack.com! Our company was contacted by the all new website, Thumbtack.com to be one of their featured Las Vegas real estate sites! It is always nice to be recognized by outside service providers for doing a great job, and we are excited about the extra promotional opportunities this will afford us to market our listings.

Speaking of new listings, we have a dandy in Green Valley Ranch! It’s a beautiful and immaculate 1769 sf 3 bedroom 2.5 bath townhome in a guard gated community across from the fabulous Green Valley District. This will go fast, so check it out at: Green Valley Town Home

Sunday, March 27, 2011

Playing Fair with Your Real Estate Agent

This week's blog is about playing fair with your real estate agent.

Last week I was in New York City visiting family, and while I was there I met my niece and her husband for lunch and a show. They live in the city - my niece is an astrophysicist and only about ten people in the world really understand what she does. Something to do with black holes and dwarf stars and galaxies far far away!

We had just settled into our seats at this great Cuban restaurant when my niece said she needed to ask me some real estate related questions. I told her I would try to answer her questions, but with the disclaimer that New York City real estate was out of my realm of expertise.

My niece and her husband have decided they need more room than they currently have, so they are looking for a two bedroom apartment. Number one on their list was an apartment with about 900 square feet, 2 bedroom 1.5 bath for $4,500 a month. (You can buy 6,000 square foot Las Vegas luxury homes around the $700,000 price range for that kind of monthly payment, including the taxes and insurance!)

She showed us the floor plan, and the second bedroom was literally 10x5 - really more of a den off the dining room. The kitchen was minimal, and the bathrooms were only just big enough to turn around in if you were on the slender side.

But here's the kicker and where the real estate question came in. They had previewed this apartment with a local real estate agent. In addition to paying $4,500 per month for the place, they were also expected to pay the real estate agent 15% of the total rental amount for the year, another $8,100! But after returning home they found the same apartment listed on another agent's web site for only $4,400 per month with the landlord paying the agent's fees.

The question: what kind of liability/responsibility did they have to the agent that showed them the apartment in the first place?

After I picked my jaw up off of the ground in amazement at how much the New York agents make on rental properties, my first question to them was whether or not they had signed any type of agency agreement with the first agent. They said she had tried to get them to sign an agency agreement, but they had declined signing her paperwork. (My niece's husband is an attorney, fortunately, and he knows better than to sign something without fully investigating the ramifications.)

So I felt pretty confident telling them that they had no financial obligation to the first agent. However, I also explained that in the Las Vegas real estate market we have what is called "procuring cause." The agent that shows the listing to a client is entitled to the commission in most circumstances as per the guidelines of our local Las Vegas MLS board. I told them I did not know if the same rules were true in New York, but it could be that if my niece and her husband used another agent, the second agent might be liable to the first agent for the commission.

I suggested that as a courtesy to the first agent they let her know that they had found the apartment online for less money and without the agent's commission being paid by the tenant. They should give her the chance to represent them if she was willing to negotiate on their behalf and collect the agent's fee from the landlord. However, if she was not willing to do that, they should contact the second agent and let that agent know the circumstances so the agent wouldn't be blind sided later in the transaction.

This way the first agent would still have the opportunity to work with them. But if she declined their terms, the second agent would be in a much better position to collect the commission for performing the job, though that would still not be guaranteed.

This is an issue that all buyers/tenants should be aware of. If an agent shows you a property, in most states they are entitled to the commission from the sale as "procuring cause" of the sale unless there are extenuating circumstances. While most of the time "procuring cause" does not affect the buyer/tenant financially, they need to be sure they are being fair to the real estate agent that has done most of the work. After all, who wants to work for free? We have seen too many situations where a buyer asks an agent to show them Las Vegas homes for days on end and then turns around and has a friend (who was either too lazy or too busy to show them homes at the time) write the offer.

You have to have a compelling reason to use another agent, or that second agent may not be entitled to compensation. A compelling reason is NOT that you prefer to use a friend or that the first agent was not available on short notice to write an offer. A compelling reason would be that you had good reason to believe that the first agent was not working in your best interests or had "abandoned" you as a client. Most of the time that is very hard to prove.

And above all, the morals and ethics of the situation call for being fair to all parties. If the real estate agent does the work, they should get compensated for that work. So if you are looking for homes for sale in Las Vegas, make sure that only the agent you expect to represent you shows you the homes you might want to buy.

Saturday, March 05, 2011

Las Vegas Real Estate Market Inventory

As real estate agents, we often are asked the question: How does the current Las Vegas real estate market inventory stack up with past years? What about this “shadow inventory” we keep hearing about in the news? Will prices go down further? Have we hit the bottom of the market yet?

Unfortunately we cannot give predictions for the future. (If we could, we would be playing the international money markets!) But we can share statistics on current listing inventory vs. previous years to give buyers an idea of how balanced the market may or may not be.

Today’s inventory - As of March 4th, 2011 there were 12,238 single family homes and 2,658 residential condos listed as active (with no contracts pending or contingent) in the Las Vegas MLS system. As of January 2011 (the most recently published report supplied by the Greater Las Vegas Association of Realtors) the average sales price of a single family home was $157,081, and the average sales price of a condo was $83,828.

Inventory in 2008 – In February of 2008, there were 22,497 active single family home listings and 5,388 active condo listings. The average sales price of single family homes was $297,597 and the average condo sales price was $276,222.

Inventory in 2005 – In February of 2005, there were 14,041 active single family home listings and 2,593 active condo listings. The average sales price of single family homes was $334,732 and the average condo sales price was $189,462.

What do these statistics tell us? They show that currently there are fewer active Las Vegas homes for sale now than there were in the height of the “boom” years, but that the sales prices are less than half of what they were at that time. We are seeing cash investors buying up the “bottom of the market” because rental yields are so good at today’s low prices. (Over 51% of the housing sales in January 2011 were cash.) Sales prices are less than the cost to build new. Most Las Vegas foreclosure listings are actually selling for over the initial list price. And some zip codes in Las Vegas even experienced appreciation during the past year.

Again, no one can predict with any accuracy what prices will be in the future – there are too many global factors that could impact sales. But indications seem to be good for those that are willing to buy and hold for the long term.

Wednesday, February 23, 2011

Las Vegas Real Estate Agents Fire Buyers!

It doesn’t happen every day, but every once in a while Las Vegas real estate agents fire buyers! Real estate agents as a whole work harder than the average person in a 9 to 5 job. They are on call 24/7, and, especially in today’s market, often work for minimum wage when you count up all the hours and expenses that go into a transaction. That is why it is especially important for real estate agents to realize the value they bring to the table and when they should fire buyers that are just not worth their time.

Sometimes the agent doesn’t know the buyer’s mindset going into a transaction, but sometimes the buyer tips their hand in advance, like this actual letter we received on Valentine’s Day. Tim writes:

“I am seriously considering buying Las Vegas homes, BUT ONLY on a KILLER DEAL. I am not interested in a good, great or market price deal. I can pay cash, so there won't be any financing. So, probably a Las Vegas foreclosure, but open to all. I know that there are killer deals out there because I know of them all around me here. So, please, only a straightshooter reply to me.

My criteria: $50-100K. House, new or newer preferably, but not mandatory, 2> beds, 1>bath, a real fireplace is a must, garage, yard or acreage, good area/part of town. I have more likes/dislikes, but these are the standard facts.

I am retired. I want to be near or in relatively close driving distance to golf courses, casinos that have concerts, places to walk and hike, and take my dog. You get the picture?

I don't have a timeframe. As I said, if it is the killer deal for me then I am ready to buy today, or willing to wait until tomorrow, in a week, month or year or more until that deal transpires.

I want an agent that knows Vegas extremely well, is not pushy, is not in desperate need of a sale, will work with me on what I want and not what they want, and obviously knows real estate. Don't laugh. There are way too many people that received their licenses during the big boom years ago that don't know a thing about real estate, and many of them are still out there with their license. Please don't reply because I will know.

If you have someone qualified and interested, let me know, and we can talk.

Tim”

Since we received this letter on Valentine’s Day, we decided to have a little fun with it and instituted our First Inaugural “Kiss Off the Client” Contest. Agents contributed entries to let Tim know (politely) why they were firing him in advance. Below are a few of the entries submitted:

“Dear Tim, You’ll be excited to know that every home for sale in Las Vegas is by definition “a killer deal”. Knowing that should take a lot of the pressure off of both of us.

The remainder of your criteria you’ll find out in Pahrump, Nevada. Are you interested in looking at a few properties there? If so, I’ll be happy to recommend an agent. Make sure to pack your snake and scorpion repellant. Judy”

“Dear Tim, I would love to help you, but sadly my dog ate your listings. As he is on an all starch diet and will probably continue to eat your Las Vegas MLS listings for the foreseeable future, you will need to find another agent to assist you. As a dog owner yourself, I am sure you understand. Good luck! Dave”

“Dear Tim, Since killer deals seem to be falling off the trees right where you are now, why would you want to come to Las Vegas? Please let me know where you are so I can get my real estate license there! Gina”

“Dear Tim, The Good News: Our Las Vegas real estate agents are all HIGHLY experienced, with pit bull negotiating skills, impeccable integrity and incredible work ethics. The Bad News: They are all so successful and already have so many wonderful, motivated clients, none of them are “available” to help you. Management”

Please feel free to use these excuses the next time you are approached by a buyer that needs to be fired!

Saturday, February 05, 2011

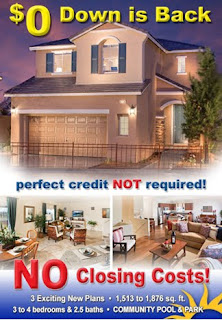

Las Vegas New Homes - $0 Down and $0 Closing!

One Las Vegas new homes builder is pulling out the stops to attract new buyers! R/S Development, a highly respected local Las Vegas developer, has announced a special $0 down payment and $0 closing cost promotion for their new Liberty Hill project in the 1200 acre master planned community of Providence.

One Las Vegas new homes builder is pulling out the stops to attract new buyers! R/S Development, a highly respected local Las Vegas developer, has announced a special $0 down payment and $0 closing cost promotion for their new Liberty Hill project in the 1200 acre master planned community of Providence.

R/S, a boutique builder in the Las Vegas Valley for almost 30 years, has long been known for the exceptional quality of their homes vs. other tract home competitors. Family owned and operated, they have won numerous Homer Awards for design.

Standard features included in the Liberty Hill Homes are:

- 13 Seer air conditioning system

- Dual Glazed Low “E” Glass Windows

- Climate enhanced balanced power heating & air conditioning system

- 40 gallon high efficiency gas water heater

- 10-year limited structural warranty from Professional Warranty Corp.

- Monier® concrete tile roof in designer coordinated colors

- Drought tolerant front yard landscaping w/ automatic irrigation system

- Fully enclosed rear yard with masonry fencing and wrought iron gate

- Fully drywalled and textured garage

- 9’ high ceilings on main floor

- Formal ceramic tile entryway

- Custom hand finished textured ceilings and walls

- Architecturally rounded corners

- Ceiling light in all bedrooms

- Attractive beech wood cabinetry with finished interiors, adjustable shelves and hidden hinges

- Energy Star rated Kenmore® appliances

To find out more details on Liberty Hill and other great deals on real estate in Las Vegas, give us a call today at 702-985-7654! But hurry before this special promotion ends.

Friday, January 21, 2011

Drive Past a Home and Get the Listing Right on Your Phone!

Just register for our new mobile text search and start cruising the areas you like the best. Using your phone, you will send a text message to our system to log on. Then you will enter the property street number and choose which street you are interested in. Our system will send you the complete MLS listing, including price plus all the photos that the listing agent has taken on the property. And if you want to schedule a showing, all you have to do is click the link right in the listing to call us immediately.

Our system will give you detailed information on ANY properties listed in the Las Vegas MLS system throughout Las Vegas, Henderson, Boulder City, North Las Vegas and Pahrump, including foreclosures and auction properties. So don’t forget to save the application right on your phone. You can use it as many times as you like. And later on when you get home, you can log on to your main computer and bring up every home you texted about for further review and comparison.

To get started, just go to: http://www.greatlasvegashomes.com/text_mls_listings.htm. You can register the cell phone numbers that you want to use, and then you will receive an email with instructions to start texting for homes!

Saturday, October 30, 2010

Selling Your Home - Las Vegas Short Sale Tips

The collapse of the general economy has left the Las Vegas real estate market in a shambles. If, like many, your home is upside down and you need/want to sell it, you are going to need the approval of your existing mortgage lender(s) to take less than what is owed. This is what we call a short sale, or pre-foreclosure property. Short sales are complicated transactions, so you can’t just hire your sister’s best friend who works part time in real estate to handle it for you. (Well, you can, but you may not be happy with the outcome.)

Who actually makes the decision to approve a short sale? As the seller, you will not be allowed to take any money from a short sale transaction. So you, the seller, really don’t care what you sell your home for. Surprisingly enough, your lender, who is probably only servicing your loan, doesn’t care either. The servicing bank merely collects the appropriate documents and presents the entire file to the investor who is actually holding the note and is owed the money. Literally, you could have two identical homes with two identical cash offers being serviced by the same bank and yet one will get approved and the other will not. It is entirely up to the investor holding your note how much of a loss they are willing to take.

Why would you short sale your home? The main advantage to doing a short sale is that you will ask your existing lender(s) to release you from any deficiency judgments. In other words, they agree not to go after you for the difference between what you owe and what the home sells for. (After a Las Vegas foreclosure they automatically have that right. On a short sale, this is negotiable.) In addition, if you can keep your payments current during the short sale process, it may not ding your credit too badly. While you won’t be able to finance another Las Vegas home for 3 years under FHA guidelines or 4 years under conventional guidelines, you should be able to buy a car or obtain credit cards. A foreclosure could prevent securing any type of credit for a number of years.

What will you need to provide to your lender to get a short sale approved? Most lenders will require the following documentation in addition to a multitude of standard forms:

· hardship letter – you are telling the lender in detail why you can no longer make your payments. Loss of employment, reduction of income, job transfer, divorce, illness, etc. In some cases the investor holding the note may still be willing to do a short sale even if you can afford the payments, but that is on a case by case basis

· last two paycheck stubs

· last two bank statements from all accounts

· last two years of tax returns

· financial worksheet showing expenses

What is the best way to go about a short sale? First of all, you would want to contact your lender to see if you qualify under the HAMP program or Home Affordable Modification Program. If you qualify under program guidelines, your lender may agree to reduce your interest rate so that you can afford to stay in your home. If you still can’t stay in your home for one reason or another, you may then qualify for the HAFA program or Home Affordable Foreclosures Alternative. Under this program you may get pre-approved for a short sale based and you may also receive relocation assistance up to $3k upon the sale of your home. Definitely something worth checking out.

The next step, whether or not you are HAFA eligible, is to hire a Las Vegas real estate agent EXPERIENCED in listing short sales. Your home must be listed on the local MLS so that the investor has a chance to receive the highest possible price on the open market. You cannot sell your property to a family member or friend either with the idea of buying it back later. Part of the bank paperwork you will be required to sign at closing is an “arm’s length” disclosure stating that you have no relationship with the buyer who purchases your property. (Breach of that disclosure is federal fraud and subject to severe penalties.)

Should you hire an attorney to help negotiate a short sale? If you have been unable to obtain a preapproved short sale under the HAFA guidelines, this is an excellent idea as long as the attorney you hire does not charge you anything at all, and only collects a fee from the bank’s proceeds upon the successful completion of the short sale. Your real estate agent should be able to help you locate a firm that has been successful in negotiating short sales, and the attorney should be brought in at the beginning of the listing process. Often if the investor proves stubborn about approving a sales price or terms of the short sale, just an attorney’s letter can alter the outcome favorably. Again, the attorney takes their fee from the bank’s proceeds at no cost to the seller or buyer.

How much should you list your home for? You are trying to establish a reasonable value for your home in the marketplace, keeping in mind that it is a short sale transaction which is not popular with either buyers or buyer agents as it may take months for them to find out if they even have a deal. Your agent should look at recently sold comparable properties and price your home at the bottom end of that spectrum but taking into account comparable condition and amenities. Once your home has been listed for several weeks without an offer, you want to do regular price reductions (your agent can advise you on how much is reasonable) until you are able to generate an offer with a solid buyer.

What happens after I get an offer on my home? Your lender, the servicing bank, puts together a file containing the contract, your updated financial documents and all documentation that you have tried to obtain the best price possible. They order a BPO or Broker’s Price Opinion (basically an appraisal) to establish market value of the home. They present this file to the investor for approval, rejection or, in many cases, counter offer if the BPO comes in higher than the sales price. If there is a counter offer on the price, the buyer may decide to accept the counter subject to a second appraisal of the property by the buyer’s lender. If both the buyer and seller accept the initial terms of the short sale approval, the buyer’s due diligence period commences. The buyer’s Las Vegas mortgage lender will order their appraisal and the buyer will complete all inspections and review any HOA documents.

Quite often the buyer’s appraisal is lower than the bank’s appraisal, and then the buyer will ask for a reduction of the sales price to meet that appraisal. The investor can either agree or disagree. Once a final price is agreed upon by all parties, the transaction proceeds pretty much as normal.

Why do most short sales fail? Most Las Vegas short sales fail simply because of the time it takes to find out if they are approved. Even the most serious buyer can become fidgety after a month or two of waiting to hear something, anything. That is why it is crucial for your agent to give weekly updates to the buyer’s agent, even if there is nothing new to report. Just a steady stream of communication can keep a deal alive. The second most common reason short sales fail is the difference in appraisal values between the short sale bank and the buyer’s lender. Again, a strong listing agent can go a long way toward documenting reasons for a lower sales price, though again this is ultimately the decision of the investor and sometimes those decisions seem to make no sense at all! But it is quite common to see the same Las Vegas homes for sale go into escrow several times before a successful closing. There is nothing wrong with the property itself, just the process.

That is why it is vital that the seller, the buyer and the agents all remain calm and be willing to jump through many hoops to a successful close. Guaranteed, there will be many hoops! But the patient buyer can get a great deal and the seller can walk away with a clean slate, and that is what makes it all worthwhile.

Friday, October 08, 2010

When is the Best Time to Close on a Las Vegas Home?

By guest blogger Jamie Cailor

We all have probably heard that it is better to close Las Vegas real estate transactions at the end of the month as opposed to mid-month or early on in the month. In fact, many borrowers are under the mistaken impression that they can save money on interest if they close later in the month.

Closings are more often scheduled for the end of the month than any other time for two reasons:

1. An offer to close by month end is more attractive to the seller as it “saves him” having to pay another mortgage payment out of pocket.

2. From the buyer’s perspective, it reduces the amount of cash needed to close in prepaid interest.

In realty, no one is actually saving any money. Las Vegas mortgage interest is paid in arrears – in other words, after you have used the money. The seller will still owe the interest from the previous month, but instead of writing a check, the amount will be deducted from his proceeds. The buyer will still be paying the interest for every day he has the loan, he just doesn’t need as much money up front. So total cost is not so much the issue as having the out of pocket cash to meet the requirements to close.

What is prepaid interest anyway? Well, prepaid interest is essentially the amount of interest due at closing to cover the period of time in the month between the date the mortgage lender closes your loan and the date your first payment is due. Say you close your loan on October 1st, paying 30 days of prepaid interest at closing. While you’ll have to pay that interest upfront, your first mortgage payment won’t be due until December 1st.

However, if you close on October 30th, and pay only one day of prepaid interest, your first mortgage payment will be due December 1st, so that first full mortgage payment will come due sooner. Either way the same amount of interest will be paid - it’s just a matter of when you pay it. But the difference in closing costs can be significant for first time home buyers strapped for cash to get into their new Las Vegas homes. So many homeowners opt to close at the end of the month to reduce their upfront closing costs.

Smart mortgage brokers will typically disclose enough prepaid interest for 15 days or more on the Good Faith Estimate to ensure borrowers have enough money to cover the costs no matter what day the loan actually closes. It’s not always easy to time a closing as “life happens,” so it’s better to overestimate, especially if you’re cutting it close with limited funds. The last thing a borrower needs is to be short on funds at the tail-end of the funding process.

And there are definite disadvantages to closing at the end of the month too. This is always a frantic time for title, escrow companies and lenders, as more than 60% of all contracts are written to close between the 25th and the 31st of each month. But there is NO guarantee that the loan will actually close at that time, and you may be out the prepaid interest anyway. Too many things can happen that delay an escrow. The homeowner’s association doesn’t submit the payoffs for the previous owner in a timely manner, the underwriter asks for more conditions at the last minute, there are mistakes on the final loan documents that need to be corrected, a Las Vegas foreclosure property might not receive final HUD signoff, the title company finds a lien or judgment has just been filed… The list can go on and on. In addition to that, other service providers, like moving companies, rental trucks and even utility companies are also jammed at the end of each month, and you may find it difficult to get the services you need.

On the other hand, if you plan your funds in advance and can close early in the month or mid-month, you’ll have a lot more time devoted to your loan documents and closing packages and it may be cheaper to rent that moving van. Plus even if something happens at the last minute that could cause a delay, the escrow officers and lenders will have more time to expedite your transaction as much as humanly possible.

All that said, perhaps you shouldn’t be looking at Las Vegas homes for sale if the amount of prepaid interest can make or break you. So be sure you have sufficient funds regardless of whenever you close your loan.

Wednesday, September 29, 2010

The Ultimate Las Vegas Party Home!

As a Las Vegas real estate agent, I have seen some really cool houses over the years. (I have thousands of great ideas I would love to try out if only my pocketbook matched my dreams.)

But Friday was extra special. I got to see a home that was 25,000 square feet of pure unadulterated Man Cave. No, that is not a typo. The home is really 25,000 square feet and is listed for $12M, which is actually an incrediblly LOW price per foot for the neighborhood and the amenities.

Anyway, one of my agents was previewing for a client that is coming to town, and she happened to ask if I would like to go with her. Usually I have to say no because I am always so slammed at work, but for once I decided to play "hooky" and tag along.

Like I said, I have seen many exclusive Las Vegas homes over the years, but this one was something else. It is located in McDonald Highlands, an exclusive gated country club community in the Green Valley Ranch area of Henderson. The property is still under construction on one acre (though the acre next door is also for sale - it is a Las Vegas bank foreclosure - and could be purchased at the same time), and it is just across the street from Rich McDonald's home - developer of McDonald Highlands.

Even unfinished, this home has loads of personality. The owner/contractor met us and gave us a personal tour and we were blown away, especially by the "play" areas of the home. Just a few of the indoor amenities in the family room included:

- ten car garage with glass viewing window from the family room so your guests can see your Bentley and Rolls without getting up off the couch

- 30 person professional theatre room with stage and dressing room for private plays

- wall length aquarium with built in TV screens that rise up within the tank so your exotic fish can enjoy HBO or Showtime along with you

- raised dias for band or DJ for your parties

- full size kitchen (that is bigger than the one in my home)

- game station area with two screens for competitive Wi matches

- full size state of the art gym

- spa room with two pedicure chairs, perfect for a girl party

- two lane regulation Brunswick bowling alley

- extra room for either your shooting range or golf practice range

The gigantic pool area was also spectacular, with swim up bar, outdoor kitchen, cascading waterfalls, bridges and multiple outdoor seating patios. Above it sits the "Poker Room," encircled by a true "lazy river" for drifting along in your innertube on a hot summer's day.

And of course the rest of the home is packed with fabulous and one of a kind ceilings, countertops, floor coverings, etc., all in very contemporary design with floor to ceiling windows and hundreds of planters scattered throughout. For the money, this may just be the best value in Vegas, and for sure it will be the most fun!! So if you are looking for the ultimate party house, give me a call and we'll go take a look.

Friday, September 17, 2010

Las Vegas Real Estate Foreclosure Auction in October!

Hudson and Marshall is back with a new auction of 153 properties in the Las Vegas Valley! This will be by far the largest auction they have held in more than a year. Auction properties will include every type of Las Vegas real estate, from small condos to single family homes to luxury high rise residences. The auction will be held at the JW Marriott hotel at 1 pm on October 9th, and auction properties will be held open for viewing the previous weekend on October 2nd and 3rd from 1 pm until 3pm.

In addition, early viewings and pre auction bidding are available through your Las Vegas real estate agent, and you should choose an agent that is thoroughly familiar with the auction process. Auction properties do NOT list prices, and your agent will need to do a lot of research to come up with an appropriate bid amount. Your agent’s commission will be paid by the seller and there is NO cost to the buyer. Since the auction house only looks at the highest bid, whether or not the buyer is representing himself or has an agent, it pays to have an experienced auction agent at your side!

One thing to keep in mind on auction properties is that there is a 5% buyer’s premium that will be added to the winning bid amount, so a Las Vegas home that goes for $150K will actually cost the buyer $150,000 plus the $7500 buyer’s premium in addition to normal buyer closing costs. Offers cannot be made with any kind of contingencies, including inspections, appraisal or financing. Escrows must close within 30 to 45 days, and on the day of the auction, successful bidders will be required to present a $2,500 non-refundable cashier's check as earnest deposit. (Many auction properties CAN be financed, as long as your lender can close within the stated time period.)

To receive a complete list of auction properties being offered, please contact us at sold@greatlasvegashomes.com and we will be delighted to send you the auction brochure.

Saturday, May 29, 2010

Real Estate Tax Credit Extended for Qualified Veterans!

Attention all Veterans! Did you know that you might still be eligible to receive a real estate tax credit on a primary home purchase? If you are relocating and would like to purchase a Las Vegas home, we would be delighted to help you take advantage of this additional benefit!

Qualified Veterans have an additional year to take advantage of the first time home buyer $8,000 tax credit or the $6,500 move up buyer tax credit for any property put under contract before April 30, 2011 as long as it closes by June 30, 2011. To be eligible, the Veteran must have served on qualified official extended duty service outside of the United States for at least 90 days during the period beginning after Dec. 31, 2008, and ending before May 1, 2010. Members of the uniformed services, the Foreign Service and employees of the intelligence community are all eligible for this special rule.

In addition, the penalty for selling a home purchased with the tax credit before three years may be waived. Normally the borrower is required to live in the property as a primary residence for three full years or be subject to repaying a prorated portion of the tax credit. But members of the uniformed services, the Foreign service or the intelligence community are exempt if a home is sold or stops being the taxpayer’s principal residence because of government orders for qualified official extended duty service. Qualified official extended duty is any period of extended duty more than 90 days while serving at a place of duty at least 50 miles away from the taxpayer’s principal residence (whether inside or outside the U.S.) or while residing under government orders in government quarters.

So not only might you still be able to receive the tax credit on your next home purchase, but you can also take advantage of the Las Vegas real estate market and our historically low prices! CNN Money has named Las Vegas the most undervalued housing market in the country. Check out the great deals you can get on Las Vegas foreclosures and come live in one of the most vibrant cities in the world.

Tuesday, April 06, 2010

Las Vegas Home Sales Up, Inventory Down

Inventory has dwindled substantially in the Las Vegas real estate market over the past couple of months, and the volume of sales so far this year has been comparable to the volume of sales in 2005, a “boom” year. First time homebuyers and move up buyers are vying for properties that will allow them to cash in on the government tax incentives being offered through April 30th. But competition with cash investors has frustrated many would-be purchasers, especially for homes listed under $250k. To be eligible for the tax credit, the property must go into escrow by April 30th, and must close no later than June 30th, 2010.

Two years ago there were more than 27,000 single family homes listed on the Las Vegas MLS system. As of the end of March 2010, there were less than 7800 active MLS single family listings. According to CNN Money, Las Vegas is currently the most under-valued market in the country, and homes are selling for less than half of what they were three years ago - far below replacement value. (Here is a link to the Las Vegas appreciation rates by zip code over the past eight years.) This lack of inventory and the low listing prices mean that Las Vegas homes in the most popular neighborhoods may receive anywhere from 10 to 50 offers ABOVE list price within the first week of being placed on the market.

Buyers who need bank financing to purchase a home are regularly losing out to the all cash investors, even though they have received a full bank pre-approval for their loan. After endless days of house hunting, it is not uncommon to see buyers who need financing put in 10 to 20 offers on different homes before securing one for themselves. And quite a few are in a panic because they are trying to meet the April 30th deadline to get a home in escrow before the $8,000 first time homebuyer tax credit expires. The low inventory situation in Las Vegas is made even more difficult by the fact that only about 30% of the 7800 single family homes actively listed are “real” sellers or Las Vegas foreclosures. The rest are “short sales” or pre-foreclosures, and it may easily take three or four months to find out if the bank holding the mortgage will even approve a short sale. Since the buyer also has to be able to close before June 30th to get the tax credit, purchasing a short sale is not even an option.

Move up buyers that want to take advantage of the $6500 tax credit and who are looking at homes over $250k are in a better position, as there is not quite as much competition from the cash investors for higher priced homes. And there are some amazing steals for those who can spend up to $1M (or more), including custom and semi custom homes in some of the Valley’s most prestigious guard gated golf course communities. The Las Vegas high rise condo market also offers some incredible deals. A penthouse near the Las Vegas Strip that originally sold for well over $2M may be listed for sale at less than $1M.

In other words, it is a great time to buy real estate in Las Vegas, and it looks like the market here may recover a lot sooner than financial experts originally predicted.

Sunday, March 07, 2010

Real Estate in Las Vegas - The Buying Process

Every country, state and city has different procedures when it comes how a real estate transaction is handled. Below is an overview of how the Las Vegas real estate purchase process is handled.

- Obtain a loan preapproval from a major bank or provide proof of funds (bank statements) for an all cash sale to your Las Vegas real estate agent. This is required before submitting any offers on properties, and some sellers will not allow you to view their property without one.

- Identify potential Las Vegas homes for sale that meet your needs and view them with your agent. Remember to give your agent as much advance notice as possible. Many properties require appointments to view, and if you can give at least a week's notice it is easier to make sure you get to see all properties on your list.

- Select property that you would like to make an offer on. Because there are multiple offers on many properties, especially those under $400k, it is wise to select several properties and not just one.

- Have your agent run comparable sales to determine an approximate value. If you are getting a loan, your lender will also require an official appraisal to be done on the property. If this is a cash sale, an appraisal is not required, but the buyer may pay for one and that can be a condition of the contract. We use the standard Greater Las Vegas Board of Realtors purchase contract which contains many provisions for the protection of both the buyers and the sellers. The only exception to using a standard GLVAR contract would be when purchasing a brand new Las Vegas homes from a developer. In that case the purchase contract is supplied by the developer.

- The agent will write up a purchase contract including all terms of the sale. The buyer will sign the contract and the agent will submit it to the listing broker along with a copy of the earnest money deposit check or a notation that these funds will be wired directly to the escrow company within one business day.

- The seller then has three choices: they can accept the contract as written, they can reject the contract, or they can make a counter offer to the buyer.

- If the seller makes a counter offer, the buyer can accept it, reject it or make another counter offer to the seller. All offers and counter offers must be in writing. Verbal offers are not acceptable.

- Once all parties have reached agreement in writing, the contract is considered accepted. The buyer's agent will submit all documents and the earnest deposit check to the escrow company and escrow will be opened. Once again, the earnest deposit will be cashed at this time and the funds will remain at the escrow company until the closing occurs.

- The buyer's Las Vegas mortgage lender will also immediately receive an executed copy of the contract so that they may start processing the loan.

- The lender should be instructed to order the appraisal immediately and collect funds for the appraisal from whoever is paying for it.

- The property inspection should also be set up immediately so that the results can be reviewed and accepted or rejected by the buyer during the due diligence period. Should there be items on the inspection list that the buyer wishes to have fixed by the seller, a separate form will be prepared itemizing those items. Keep in mind that Las Vegas foreclosures and short sales are mostly sold "as is, where is" with no repairs to be made. Short sale sellers have no money, and Banks will very seldom pay for any inspection items unless a major issue is found like mold or a structural defect.

- HOA docs should be ordered immediately so that the buyer can review them in a timely fashion within the due diligence period.

- The buyer should also immediately contact their preferred homeowner's insurance company and order a homeowner's policy. The buyer will need to supply the property address, the property square footage and both the lender' and escrow company's contact information so that the insurance company can provide them with the necessary paperwork for closing.

- Once the items of the due diligence period have been covered and the due diligence period ends, the buyer's earnest deposit is considered non refundable unless the seller is unable to provide clear title to the property or the property is materially damaged in some way prior to the closing.

- About three days prior to the closing, the buyer will have an opportunity to "walk through" the home once more to make sure that the property is still in the same condition as it was when the offer was tendered. Also if there were repairs that were to be made by the seller, the buyer would check to make sure that those repairs have been done. If the buyer is unable to be at the property for the walk through, the buyer may nominate someone else in writing to perform this walk through on the buyer's behalf. The real estate agent may be present during the walk through, but CANNOT do the walk through for the buyer. If the buyer or a buyer's nominee cannot do the walk through, the buyer will need to waive his rights to the walk through in writing.

- About three days before closing, the buyer will sign all the closing documents and lender documents, if applicable. The escrow company will have prepared an estimated HUD settlement statement outlining all fees being charged and this will be reviewed for accuracy by the buyer and the buyer's agent. The lender documents will be returned to the lender for review, and then the lender will wire mortgage funds to the escrow company. The buyer will deposit the remaining funds needed to close by WIRE TRANSFER only. Escrow companies will not accept cashier's checks as "good" funds. If a cashier's check is used, the escrow company will wait five to ten days for the check to clear. This will delay closing and may result in fees and penalties to the buyer.

- About three days before closing the buyer will call the utility companies to have the utilities turned on in their name at the close of escrow date.

- Once the property is officially recorded in the buyer's name at the Clark County Recorder's office, the buyer is obtains access to the property and keys from the seller. Prior to recording, no work may be done on the property by the buyer and no furnishings may be installed without prior written permission from the seller. (Bank owned properties never allow any kind of access prior to recording.)

- Recording a property on the specified closing date is not an exact science, though we do everything we can to accomplish this goal. Some of the most common delays are: the HOA does not return the demands to escrow on time, the seller does not sign off on the final HUD statement, the loan documents need to be resigned because of a clerical error, escrow is waiting on the lender funds, final repairs have not been made, or title needs to clear a lien. These are all items outside of the control of the buyer or the buyer's agent, and a sense of humor helps to get through the process.

For non US Citizens: the above process for purchasing Las Vegas homes is the same for US and non US Citizens. One other item that foreign nationals need to be aware of when purchasing property in the United States: when you eventually sell the property, a certain percentage of any profit over the original sales price will be withheld at the closing to pay US federal taxes.

Taking title to property as an LLC or Corporation: it is possible to take title to a property in the name of a US registered Corporation or LLC if you are paying cash for a property, but the purchase contract must contain this information when it is presented to the seller. Most sellers will not sign a contract that allows an assignee to take over the contract. You must also provide your real estate agent with the appropriate documentation proving you are authorized to sign for that entity. Otherwise you will have to wait until after the transaction is closed and then transfer the property into the entity's name, at which time you would be subject to the applicable Nevada transfer tax for that change of title. If you are transferring title to a trust containing the names of the principals, transfer tax is not required.

Tuesday, January 26, 2010

Las Vegas Home Sales Indicate Cash is King

Yes, Las Vegas is definitely having a half price sale! Prices have dropped on average of 59.2% from their all time highs in early 2006. But despite reports of doom and gloom in the local and national press about the Las Vegas real estate market, the actual sales volume stats for the year 2009 say something different. The total number of closings for single family homes in 2009 finished at 38,127, a 53% increase over closings in 2008. Condos and town home sales volume finished the year at 8752 closings, a 137% increase over 2008.

In fact, total closings in 2009 actually EXCEEDED the number of closings in 2005, the former sales volume annual record holder. Inventory for single family homes is down to 9,119 as of today’s date compared to a peak inventory of 26,000. Of the available homes currently on the market, almost half are short sales and the rest are divided pretty evenly between Las Vegas bank foreclosures and “real” sellers.

And why is the inventory of Las Vegas homes for sale so far down and why was the 2009 sales volume so high? Investors, attracted by the low sales prices which yield a good rate of return for rental income, are flocking back to the city. They are coming with cash and competing with first time homebuyers and move up buyers for the limited number of available listings.

December closings sold according to the following terms:

Cash 41% with an average sales price of $117,522

Conv 23% with an average sales price of $192,915

FHA 30% with an average sales price of $143,515

VA 5% with an average sales price of $188,113

Prices in some of the most popular areas of the Las Vegas Valley actually appreciated a small percentage in December, most notably in Summerlin, Anthem and the Southwest. The big banks are still sitting on a large number of foreclosures that have never been put on the market, but sources indicate that they will only be releasing these in controlled numbers over the next year or two so that prices remain stabilized.