Through October 9th Toll Brothers is giving away up to $14,200 in incentives to buyers that purchase new homes in Las Vegas during their national sales event. Toll Brothers is one of America’s highest quality home builders, with outstanding upgrades included as standard options.

Buy a new home from Toll Brothers during their national sales event (sign a contract through October 9th) and receive your choice of $4700 worth of options from their sales brochure, PLUS a $3,000 carpet allowance AND another $6,500 that can be used for more design center upgrades or closing costs. This is more than double their every day incentive package. With interest rates still historically low, this is the perfect time to buy Las Vegas real estate, and Toll Brothers is a Realtor preferred home builder.

Toll Brothers currently has three gorgeous communities in the Las Vegas Valley to select from. Two of the communities, Barcelona and Traccia, are located in the prestigious Summerlin master planned community which has over 50 miles of community trails, nine world-class golf courses, convenience stores, parks, trails and Red Rock Canyon Conservation Area

Barcelona is an intimate gated enclave of homes with spacious two-story home designs featuring up to 3,600 square feet of living space. Homes come with large pool-sized home sites, slab granite countertops, expansive second floor decks, 3 car garages and are Energy Star efficient.

Traccia is a collection of low-maintenance Mediterranean-inspired home designs, featuring up to 1,685 square feet of living space in a gated community with private clubhouse, two sparkling pools, lighted tennis courts, and fitness center. Choose from two spacious 3 bedroom floor plans with slab granite countertops, 2 car garages and Energy Star ratings.

The third community, Toll Brothers at Inspirada, is located high in the southern foothills of the Las Vegas Valley. These residences include access to miles of community trails, Sloan Canyon Conservation Area, two pools, recreation center, outdoor amphitheater, bocce ball courts, play ground, picnic and BBQ areas.

Toll Brothers at Inspirada offers a variety of upscale residences without the upscale price tag! This community includes both townhomes (1700 sf to 1900 sf) and single family homes (2100 sf to 2464 sf). All residences come with 2 car garages and are Energy Star rated.

To view the pricing and floor plans on these fine residences, please go to: Toll Brothers in Las Vegas

Then give us a call at 702-985-7654 to set up your private tour!

Wednesday, September 28, 2011

Toll Brothers Giving Away Up to $14,200 in Incentives!

Saturday, February 05, 2011

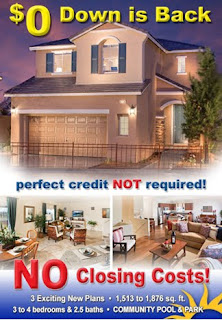

Las Vegas New Homes - $0 Down and $0 Closing!

One Las Vegas new homes builder is pulling out the stops to attract new buyers! R/S Development, a highly respected local Las Vegas developer, has announced a special $0 down payment and $0 closing cost promotion for their new Liberty Hill project in the 1200 acre master planned community of Providence.

One Las Vegas new homes builder is pulling out the stops to attract new buyers! R/S Development, a highly respected local Las Vegas developer, has announced a special $0 down payment and $0 closing cost promotion for their new Liberty Hill project in the 1200 acre master planned community of Providence.

R/S, a boutique builder in the Las Vegas Valley for almost 30 years, has long been known for the exceptional quality of their homes vs. other tract home competitors. Family owned and operated, they have won numerous Homer Awards for design.

Standard features included in the Liberty Hill Homes are:

- 13 Seer air conditioning system

- Dual Glazed Low “E” Glass Windows

- Climate enhanced balanced power heating & air conditioning system

- 40 gallon high efficiency gas water heater

- 10-year limited structural warranty from Professional Warranty Corp.

- Monier® concrete tile roof in designer coordinated colors

- Drought tolerant front yard landscaping w/ automatic irrigation system

- Fully enclosed rear yard with masonry fencing and wrought iron gate

- Fully drywalled and textured garage

- 9’ high ceilings on main floor

- Formal ceramic tile entryway

- Custom hand finished textured ceilings and walls

- Architecturally rounded corners

- Ceiling light in all bedrooms

- Attractive beech wood cabinetry with finished interiors, adjustable shelves and hidden hinges

- Energy Star rated Kenmore® appliances

To find out more details on Liberty Hill and other great deals on real estate in Las Vegas, give us a call today at 702-985-7654! But hurry before this special promotion ends.

Sunday, March 07, 2010

Real Estate in Las Vegas - The Buying Process

Every country, state and city has different procedures when it comes how a real estate transaction is handled. Below is an overview of how the Las Vegas real estate purchase process is handled.

- Obtain a loan preapproval from a major bank or provide proof of funds (bank statements) for an all cash sale to your Las Vegas real estate agent. This is required before submitting any offers on properties, and some sellers will not allow you to view their property without one.

- Identify potential Las Vegas homes for sale that meet your needs and view them with your agent. Remember to give your agent as much advance notice as possible. Many properties require appointments to view, and if you can give at least a week's notice it is easier to make sure you get to see all properties on your list.

- Select property that you would like to make an offer on. Because there are multiple offers on many properties, especially those under $400k, it is wise to select several properties and not just one.

- Have your agent run comparable sales to determine an approximate value. If you are getting a loan, your lender will also require an official appraisal to be done on the property. If this is a cash sale, an appraisal is not required, but the buyer may pay for one and that can be a condition of the contract. We use the standard Greater Las Vegas Board of Realtors purchase contract which contains many provisions for the protection of both the buyers and the sellers. The only exception to using a standard GLVAR contract would be when purchasing a brand new Las Vegas homes from a developer. In that case the purchase contract is supplied by the developer.

- The agent will write up a purchase contract including all terms of the sale. The buyer will sign the contract and the agent will submit it to the listing broker along with a copy of the earnest money deposit check or a notation that these funds will be wired directly to the escrow company within one business day.

- The seller then has three choices: they can accept the contract as written, they can reject the contract, or they can make a counter offer to the buyer.

- If the seller makes a counter offer, the buyer can accept it, reject it or make another counter offer to the seller. All offers and counter offers must be in writing. Verbal offers are not acceptable.

- Once all parties have reached agreement in writing, the contract is considered accepted. The buyer's agent will submit all documents and the earnest deposit check to the escrow company and escrow will be opened. Once again, the earnest deposit will be cashed at this time and the funds will remain at the escrow company until the closing occurs.

- The buyer's Las Vegas mortgage lender will also immediately receive an executed copy of the contract so that they may start processing the loan.

- The lender should be instructed to order the appraisal immediately and collect funds for the appraisal from whoever is paying for it.

- The property inspection should also be set up immediately so that the results can be reviewed and accepted or rejected by the buyer during the due diligence period. Should there be items on the inspection list that the buyer wishes to have fixed by the seller, a separate form will be prepared itemizing those items. Keep in mind that Las Vegas foreclosures and short sales are mostly sold "as is, where is" with no repairs to be made. Short sale sellers have no money, and Banks will very seldom pay for any inspection items unless a major issue is found like mold or a structural defect.

- HOA docs should be ordered immediately so that the buyer can review them in a timely fashion within the due diligence period.

- The buyer should also immediately contact their preferred homeowner's insurance company and order a homeowner's policy. The buyer will need to supply the property address, the property square footage and both the lender' and escrow company's contact information so that the insurance company can provide them with the necessary paperwork for closing.

- Once the items of the due diligence period have been covered and the due diligence period ends, the buyer's earnest deposit is considered non refundable unless the seller is unable to provide clear title to the property or the property is materially damaged in some way prior to the closing.

- About three days prior to the closing, the buyer will have an opportunity to "walk through" the home once more to make sure that the property is still in the same condition as it was when the offer was tendered. Also if there were repairs that were to be made by the seller, the buyer would check to make sure that those repairs have been done. If the buyer is unable to be at the property for the walk through, the buyer may nominate someone else in writing to perform this walk through on the buyer's behalf. The real estate agent may be present during the walk through, but CANNOT do the walk through for the buyer. If the buyer or a buyer's nominee cannot do the walk through, the buyer will need to waive his rights to the walk through in writing.

- About three days before closing, the buyer will sign all the closing documents and lender documents, if applicable. The escrow company will have prepared an estimated HUD settlement statement outlining all fees being charged and this will be reviewed for accuracy by the buyer and the buyer's agent. The lender documents will be returned to the lender for review, and then the lender will wire mortgage funds to the escrow company. The buyer will deposit the remaining funds needed to close by WIRE TRANSFER only. Escrow companies will not accept cashier's checks as "good" funds. If a cashier's check is used, the escrow company will wait five to ten days for the check to clear. This will delay closing and may result in fees and penalties to the buyer.

- About three days before closing the buyer will call the utility companies to have the utilities turned on in their name at the close of escrow date.

- Once the property is officially recorded in the buyer's name at the Clark County Recorder's office, the buyer is obtains access to the property and keys from the seller. Prior to recording, no work may be done on the property by the buyer and no furnishings may be installed without prior written permission from the seller. (Bank owned properties never allow any kind of access prior to recording.)

- Recording a property on the specified closing date is not an exact science, though we do everything we can to accomplish this goal. Some of the most common delays are: the HOA does not return the demands to escrow on time, the seller does not sign off on the final HUD statement, the loan documents need to be resigned because of a clerical error, escrow is waiting on the lender funds, final repairs have not been made, or title needs to clear a lien. These are all items outside of the control of the buyer or the buyer's agent, and a sense of humor helps to get through the process.

For non US Citizens: the above process for purchasing Las Vegas homes is the same for US and non US Citizens. One other item that foreign nationals need to be aware of when purchasing property in the United States: when you eventually sell the property, a certain percentage of any profit over the original sales price will be withheld at the closing to pay US federal taxes.

Taking title to property as an LLC or Corporation: it is possible to take title to a property in the name of a US registered Corporation or LLC if you are paying cash for a property, but the purchase contract must contain this information when it is presented to the seller. Most sellers will not sign a contract that allows an assignee to take over the contract. You must also provide your real estate agent with the appropriate documentation proving you are authorized to sign for that entity. Otherwise you will have to wait until after the transaction is closed and then transfer the property into the entity's name, at which time you would be subject to the applicable Nevada transfer tax for that change of title. If you are transferring title to a trust containing the names of the principals, transfer tax is not required.

Friday, October 03, 2008

Financing Las Vegas Real Estate for Foreign Nationals

With the dollar expected to rise against foreign currencies later this year (that trend has already started), foreign investors are hurrying to purchase real estate in the US while their dollar goes further. Most of these investors are targeting the Las Vegas real estate market in particular, where the sharp decline in prices (due to the high amount of Las Vegas foreclosures) and the world class amenities have made it an attractive get-away destination. In particular, Canadian buyers are looking to Las Vegas homes as a vacation retreat from their harsh winter climate.

Most banks will not loan on real estate outside of their own country. With all the recent shifts in the credit markets, the qualifying criteria has changed for mortgage loans in the United States across the board, including those to foreign purchasers. Prior to this year, a foreign national could obtain financing from US banks as long as they had 35% to put down with no or limited documentation. Now US mortgage lenders are requiring full documentation of income and assets on all mortgage loans without exception, though the down payment requirements have dropped.

A citizen of a country other than the US can obtain a loan for property in the US based on what classification they fall under. A permanent resident alien is a foreign national who has been granted the right to work in the US permanently and who has been given a US social security number. A permanent resident alien can purchase property under the same guidelines as a US citizen. They can get a loan with as little as 5% down payment for a primary residence, either on a fixed rate or adjustable rate mortgage at the current interest rates available to US citizens.

All other foreign nationals, including those with temporary work visas, are required to put down a minimum of 25% for properties under $650,000 or 35% for properties over $650,000, whether the property is a primary residence or a rental property. Lenders will also require the equivalent of a US TRW rating as well as full documentation of their employment income and assets. In addition, the down payment money must be “seasoned” in a US bank for at least 60 days prior to the close of escrow.

These loans to foreign nationals are only currently available as adjustable rate mortgages or ARMS. The fixed rate terms can be for 3, 5, 7 or 10 years and interest rates are currently running between 7.5% and 8.5% with approximately 5 loan discount points prepaid for the amount of the loan (points can vary on a day to day basis just like interest rates). Each point is the equivalent of 1% of the loan amount, so on a $100,000 loan 5 points would be $5,000.

Another alternative is for the foreign national to obtain an equity credit line on their property in their home country and come to the US with cash in hand. Cash offers are very strong, and enable the buyer’s agent to negotiate the best possible price on behalf of their client.

For more information on getting qualified for a Las Vegas mortgage and to receive the latest listings on great deals in Las Vegas new homes, high rise condos or MLS listings, please contact our office at 702-985-7654 or email us at sold@greatlasvegashomes.com.